Energy Supply Developers, LLC

Supporting the

Electrification

Movement

About Energy Supply Developers, LLC

INTRO

Energy Supply Developers, LLC (“ESD”) was formed by Bob Galyen, former CTO of CATL and one of the most knowledgeable professionals in the global battery industry, and Jack Perkowski, an international businessman with extensive capital markets, automotive and China experience, to provide strategic advisory services to battery and battery related companies throughout the world. ESD was incorporated in the State of Delaware in March 2021.

RATIONALE

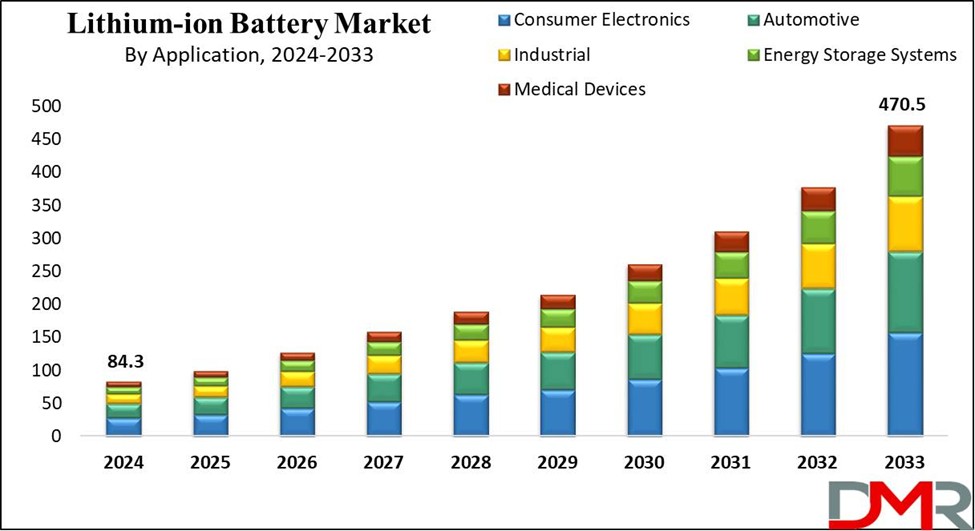

Global demand for batteries is increasing due to the rapidly improving economics of electric vehicles and the growing demand for energy and data storage systems (“BESS”) required by Artificial Intelligence (“AI”). As electrification demand grows, the market for Li-ion batteries is projected to increase significantly over the coming decade. Because global battery production is currently dominated by a handful of Chinese and East Asian players, there is a need in the United States and many other countries to onshore critical parts of its battery value chain for reasons of national security and long term economic viability.

THE GROWING DEMAND FOR BATTERIES

◼ Consumer Electronics: Smartphones, laptops, capsules and wearable technology.

◼ Industrial Applications: Heavy machinery, forklifts, military equipment, marine vessels, drones and aerospace technologies.

◼ Medical Devices: Pacemakers, defibrillators, and portable diagnostic devices.

◼ Electric Vehicles: Passenger cars, buses and motorcycles.

◼ Energy Storage Systems: Provide electric grid stability, peak shaving, and backup power for data centers.

Source: Dimension Market Research

NEW ENTRANTS

Apart from the well-established, international battery manufacturers, a large number of battery start-ups with new technologies, as well as companies that wish to supply the key materials and components required to manufacture batteries, are entering the industry.

The categories of companies seeking to enter the battery industry are as follows:

- Existing, well established companies with significant revenues and earnings that are not in batteries presently, but which operate in closely related fields and are seeking to manufacture batteries or enter some part of the battery value chain.

- International battery companies seeking to establish battery manufacturing facilities in their domestic markets and in the United States of America.

- International battery value chain companies seeking to expand into the global battery markets, including the market in the USA.

- Battery and battery value chain start-ups.

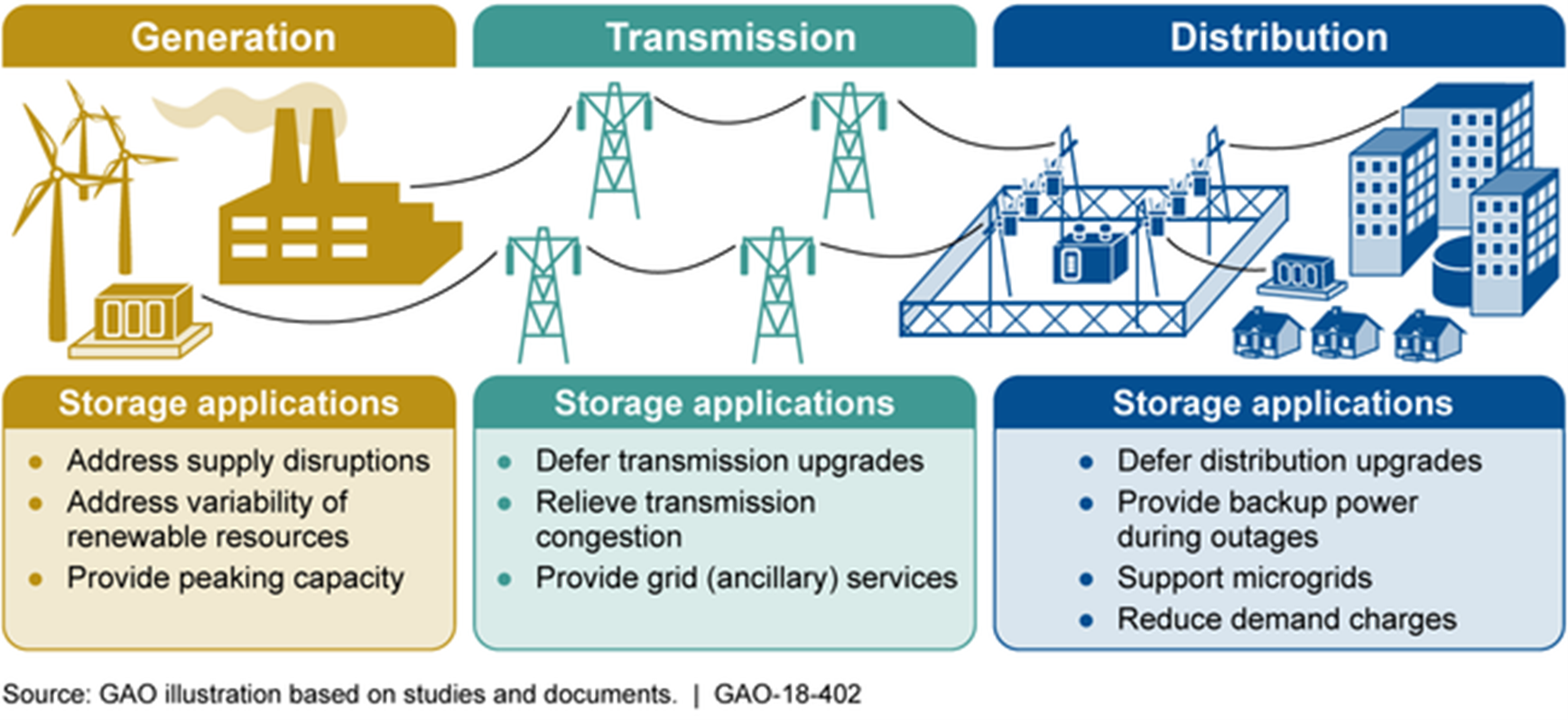

While large auto companies are partnering with established cell producers to manufacture batteries in the United States for electric vehicles, the demand for advanced batteries goes well beyond applications for mobility. For example, the U.S. government projects that electric grid capacity must roughly triple by 2040 to accommodate the explosive growth of artificial intelligence, data centers, and domestic reindustrialization efforts.

Moreover, companies that require batteries in smaller quantities for applications in industries such as consumer electronics and medical devices remain underserved and must rely on overseas battery producers and a long, costly and potentially unstable supply chain. Recent events have underscored the importance of having domestic sources of battery production, which includes all of the key elements of the battery value chain.

Opening Panel, 2025 Battery Show–Moderator John Warner, Chief Customer Officer for American Battery Solutions, said that: “The path to battery manufacturing success involves navigating three distinct ‘valleys of death.’”

Bob Galyen, Chairman of ESD, seated at far left.

In the face of such demand, many cell producers and battery materials suppliers do not have the capital and other resources needed to undertake large land acquisition and construction projects that are necessary to design and build manufacturing facilities with economies of scale.

Power for model training and inference, has led to exponential growth in data center electricity use, of which battery storage is an essential component for backup, peak shaving, and reliability.

Data centers are rapidly adopting battery energy storage systems to ensure uptime and energy efficiency as traditional backup generators cannot scale to meet the power spikes created by large AI models.

The shift toward electrification and AI has accelerated demand for advanced batteries with improved lifespan, reliability, and fast-charging capabilities, requiring both innovations in battery chemistry and deployment of large-scale installations.

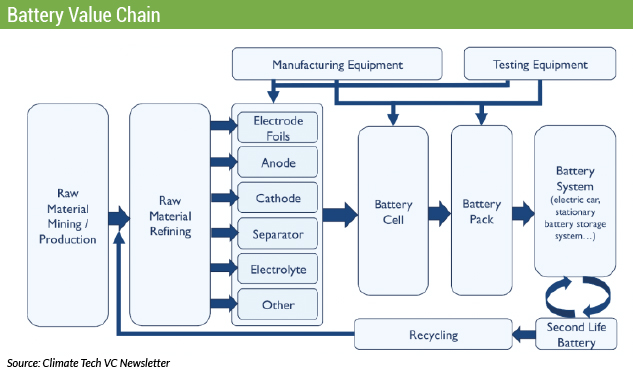

Battery manufacturing involves a complex and highly specialized series of steps that transform mined raw materials into high-performance energy storage units. This process sits at the heart of a vast global supply chain that spans raw material extraction, chemical refinement, component fabrication, full battery cell assembly into modules and packs and recycling.

Battery Value Chain

Battery manufacturing involves a complex and highly specialized series of steps that transform mined raw materials into high-performance energy storage units. This process sits at the heart of a vast global supply chain that spans raw material extraction, chemical refinement, component fabrication, full battery cell assembly into modules and packs and recycling.

The process of manufacturing batteries begins with raw material preparation, where essential minerals such as lithium, nickel, cobalt, manganese, and graphite are refined into usable powders.

These materials are mixed with binders and solvents to form slurries used in electrode production, which includes coating, drying, calendaring, and cutting of electrode sheets. These are then stacked with separators in cell assembly and enclosed in protective casings. The next step is electrolyte filling, sealing, and forming a solid electrolyte interface through controlled charging and discharging cycles. Batteries are then aged, tested for safety and performance, and finally integrated into modules and packs for EVs or storage systems.

Critical minerals form the foundation of the battery industry. The most common chemistries today are nickel-cobalt-manganese (“NCM”) and lithium-iron-phosphate (“LFP”). While lithium-ion remains dominant, new chemistries are emerging, including solid-state, sodium-ion, and lithium-sulfur batteries, which promise lower costs, higher safety, and reduced dependence on scarce materials.

Sustainability is gaining importance throughout battery manufacturing. Companies are adopting cleaner mineral extraction methods, automating recycling operations, and designing battery packs for end-of-life material recovery. Emerging circular economy approaches aim to reclaim lithium, cobalt, and nickel from end-of-life EV batteries—reducing costs, emissions, and raw material dependency.

THE BATTERY VALUE CHAIN IN THE USA

Artificial intelligence is sharply increasing demand for batteries, particularly in data centers and energy-intensive computing applications. The surge in AI-driven workloads, requiring massive computational power for model training and inference, has led to exponential growth in data center electricity use, of which battery storage is an essential component for backup, peak shaving, and reliability. Data centers are rapidly adopting battery energy storage systems to ensure uptime and energy efficiency as traditional backup generators cannot scale to meet the power spikes created by large AI models.

Large AI users such as Google, Amazon and Facebook; automakers; and the U.S. Government are promoting the growth of the country’s electrical grid and the electrification of all industries.

The major difficulty confronted by the USA today is the lack of a battery manufacturing infrastructure, including a battery supply chain, to support the expected growth of the country’s electrical grid and AI industry. USA battery makers need to identify and develop reliable sources of battery materials and battery processing capability that meet the defense and security concerns of the USA. Moreover, military applications, the projected growth in AI and electrification generally have accelerated demand for advanced batteries with improved lifespan, reliability, and fast-charging capabilities, requiring both innovations in battery chemistry and deployment of large-scale installations.

Services Provided By ESD

Strategic Business Development and Technology Advisory:

- Identify and introduce potential strategic and technology partners and customers.

- Evaluate new and existing technologies and their potential applications in the global battery market.

- Identify and introduce key global suppliers of battery and other manufacturing equipment.

- Identify and introduce global suppliers of key materials needed in the production of batteries, with a focus on those suppliers with active plans to establish manufacturing capacity in their respective countries.

- Leveraging the extensive operating experience of its principals, assist in the design, installation and implementation of global quality practices once a manufacturing facility is established.

“Turnkey” Manufacturing Solutions in the USA:

- Provide state overviews and advice as to negotiating incentive packages.

- Assist in site location and evaluation.

- Assist in the design of manufacturing facilities.

- Locate and purchase land for construction of manufacturing facilities.

- Arrange for construction of “build to suit” manufacturing facilities.

- Through ESD Ningde, arrange and finance the acquisition of manufacturing equipment from manufacturers located in the world’s largest battery market.

Capital Raising:

- Advise as to best ways to access government grants and loans.

- Provide access to long term capital and facility financing alternatives.

In summary, ESD provides a complete solution that makes the job of establishing a presence in the global battery business more manageable by:

Identifying and introducing potential strategic partners.

Assisting clients to develop a strategy for the battery business.

Working with its clients to design and construct a facility that meets their individual requirements.

Developing construction financing and long term financing for the client’s facility.

Negotiating with the local governments to obtain favorable tax and other policies

Identifying, sourcing and procuring the proper equipment.

Equipment Sourcing

Ningde ESD International Trading Co., Ltd.

In 2024, China’s lithium-ion battery manufacturing capacity reached approximately 1,170 GWh, a 24% increase from 2023. As the world’s leader in the production of lithium ion batteries, China’s equipment manufacturers are also the global leaders in the production of equipment used in their manufacture, as well as the equipment used to produce electrolytes, cathode and anode materials and other key components needed in battery production.

In order to better serve its clients, ESD has established Ningde ESD International Trading Co., Ltd. (“ESD Ningde”) in partnership with Galyen Energy LLC, to source equipment and materials from Chinese equipment makers.

Through its team in China, ESD Ningde can identify the most appropriate equipment suppliers in the country; negotiate the purchase of equipment on the most favorable terms; purchase the equipment in China on behalf of its clients; and arrange for export and delivery to the destinations designated by its clients.

For clients interested in finding alternative ways to finance the establishment of battery manufacturing facilities in the US, Europe or other locations, ESD Ningde’s lease financing partners can provide long term leasing alternatives to qualified companies.

SENIOR LEADERSHIP AND SHAREHOLDERS

Bob Galyen

Chairman

Formerly the Chief Technology Officer of CATL, the world’s largest lithium ion battery company, Mr. Galyen serves as Chairman of the Board of Directors of ESD, bringing over forty years of experience in the battery space to the Company. Mr. Galyen’s energy storage experience ranges from large corporations such as CATL, Magna, Delphi and General Motors, to small entrepreneurial businesses such as Tawas, Indy Power Systems and World Energy Labs.

Mr. Galyen served as Chairman of SAE International Battery Standards Steering Committee for eight years and as Chairman of NAATBatt International. Mr. Galyen also serves on Senator Lugar’s Advisory Board for Renewable Energy at IUPUI; the Dean’s Executive Advisory Council at Ball State University; and the National Fire Protection Agencies Board of Advisers. Mr. Galyen holds Master of Arts and Bachelor of Science degrees in Chemistry from Ball State University.

Mr. Galyen’s notable Awards include the prestigious China Friendship Award (2015); the Talent 1000 Award where he was named a “National Distinguished Expert” by China (2014); Ball State University’s “Circle of Distinction Award;” the Automotive News “Electrifying 100; “SAE International’s “Technical Standards Board Outstanding Contribution Award;” and the General Motors “Best of the Best” Award.

In 2020, Mr. Galyen founded Galyen Energy, LLC, which advises numerous companies involved in battery and energy storage. Mr. Galyen serves on the Boards of Directors and the Technology Advisory Boards for multiple companies.

Jack Perkowski

Founder, Director and Chief Executive Officer

Upon graduating Cum Laude from Yale (1970), where he received the Gordon Brown Memorial Prize awarded each year to the outstanding member of the Junior Class, and the Harvard Business School (1973) where he graduated with High Distinction and was named a Baker Scholar, Mr. Perkowski spent 20 years on Wall Street, rising to head of Investment Banking at PaineWebber.

In 1990, well before others recognized the significant role that China would play in the global economy, Mr. Perkowski spent three years investigating opportunities in Asia and China and founded ASIMCO Technologies in 1994. As ASIMCO’s Founder, Mr. Perkowski developed the strategy and raised $450 million of capital that enabled ASIMCO to become a major auto parts supplier in China. Under Jack’s leadership, ASIMCO gained a reputation for developing local management and integrating a broad based China operation into the global economy. ASIMCO was three times named one of the “Ten Best Employers in China,” and in 2008, Mr. Perkowski was designated by China Auto News as one of “30 Outstanding Entrepreneurs in China’s Auto Components Industry over the 30 Years of Economic Reform,” the only foreigner to receive this distinction. Often referred to as “Mr. China,” Jack is widely recognized as an expert on doing business in the country. Jack authored Managing the Dragon: How I’m Building a Billion Dollar Business in China.

In 2009, Mr. Perkowski founded JFP Holdings, Ltd., a Beijing based Merchant Banking Firm where he now serves as Chairman. JFP Holdings assists Western companies to penetrate the China market and Chinese companies to expand abroad.

Mr. Perkowski is Chairman of Graphene Manufacturing Group, an Australian company that produces high purity graphene from natural gas and has developed several disruptive end use products, including a graphene coating to increase thermal efficiency; a graphene lubricant that significantly improves fuel efficiency; and a next generation aluminum-ion battery; serves on the China Advisory Council of Magna International Inc., one of the world’s largest auto suppliers; is a member of the Board of Advisors for the Center For Emerging Markets at Northeastern University; and is the Co-Chair of the Finance Committee of NATTBatt, a trade association that promotes advanced battery technology in North America.

Jim O’Neill

Director, Chief Financial & Strategy Officer (Beijing, China)

Mr. O’Neill is a Founding Shareholder of ESD and the Managing Partner of JFP Holdings who brings over 25 years of international investment banking private equity experience to the Company. Prior to JFP Holdings, Mr. O’Neill founded Jin Niu Investment, a China-based strategic and investment advisory firm. Before moving to Beijing, where he is now based, Mr. O’Neill managed a $2.2 billion emerging market PE investment program for Trust Company of the West, a large U.S. investment firm.

Philip Shao

Managing Director (Shanghai, China)

Mr. Shao is a shareholder of ESD, and a senior member of JFP Holdings, which he joined in 2016. Mr. Shao has over 20 years’ manufacturing experience, including 15 years at senior positions such as Deputy GM, COO and General Manager, and 11 years experience in automotive components. Mr. Shao’s principal working experience includes senior positions at ASIMCO Technologies and Timken, and engineering positions at Changhong Electric. Mr. Shao holds a Master of Engineering degree from Chongqing University and a Bachelor of Engineering degree from Xi’an Jiaotong University.

John Liang

Managing Director (Beijing, China)

Mr. Liang is a shareholder of ESD and a senior member of JFP Holdings which he joined in 2010. Mr. Liang has over 15 years experience in the domestic and global automotive industries, having been a sales and marketing executive in several major automotive companies, including China Auto Electronic Group, Tenneco, ASIMCO Technologies and NORINCO (China Northern Industries Corporation). Mr. Liang holds a Bachelor of Engineering degree in Automotive Engineering and a Master’s degree in Management from Tianjin University.

JFP Holdings, LTD. – ESD’S China Partner

Founded by Jack Perkowski in 2009, JFP Holdings is a Beijing based Merchant Banking firm that was formed to leverage the more than 25 years of experience that Jack and his team have building and operating businesses in China.

As a result of this experience, JFP Holdings is uniquely positioned to assist Western companies to develop, fund and implement their strategies for the China market, and to assist Chinese companies to expand globally.

The on-the-ground presence that JFP Holdings has in China includes more than a dozen professionals with deep experience in China and significant investment banking experience. JFP Holdings Partners in the United States, Korea and Japan provide the firm with a global reach.

The JFP Holdings team works hand in hand with ESD on all projects involving China and/or capital raising activities. For more information on the firm, click on to: www.jfpholdings.com

Areas of Operation

ESD is working with companies from all over the world, small and large, that wish to establish a manufacturing presence in the USA. In order to better service its clients, ESD has aligned itself with trusted partners that provide legal, accounting and tax advice; are experienced in site selection and negotiating incentive packages with local governments; and that represent a wide range of financing sources.

ESD is working with Australian companies that are interested in developing customers in the global supply chain for raw materials and new battery technologies that they are developing.

China is the undisputed world leader in batteries. Through JFP Holdings, ESD’s China Partner, ESD has an on-the-ground presence in the country, and is actively working with Chinese companies to develop their business in China and the global battery market.

Countries in the European Union have made a commitment to developing the electric vehicle industry. As a result, major battery makers such as CATL are developing manufacturing facilities in Europe, creating a need for an EU battery supply chain.

ESD is working with the leading lead acid battery company in South America to establish a lithium-ion battery capability to serve mobility and energy storage markets throughout the region. ESD services include providing strategic and technical advice, as well sourcing equipment from China.

ESD is working with the leading lead acid battery company in Southeast Asia to improve the performance of its lead acid batteries and to establish a lithium-ion battery capability to serve mobility and energy storage markets throughout the region. ESD services include providing strategic and technical advice, as well sourcing equipment from China.

CONTACT US

For more information about the ways in which ESD can assist you to develop your battery business, please contact: